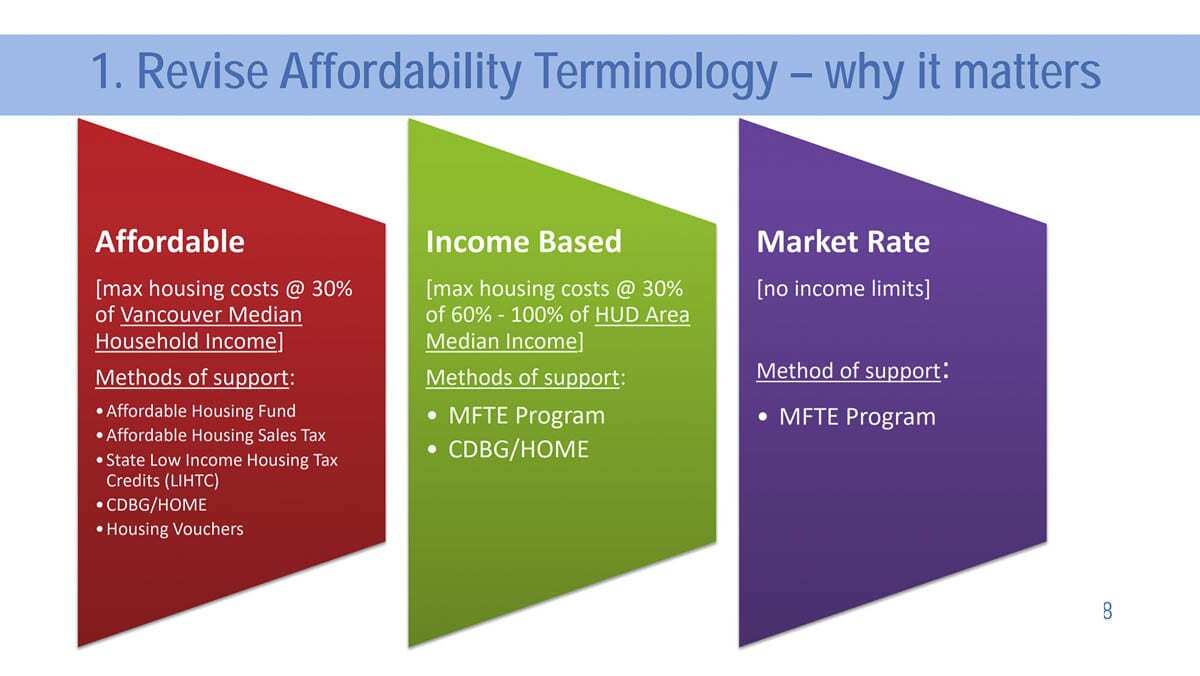

This first phase would involve moving qualified housing from affordable to income-related housing

VANCOUVER – After months of debate, Vancouver City Council appears poised to approve the first phase of its plan to revise the Multi-Family Home Tax Exemption (MFTE).

The Downtown Vancouver Block 10 development is one of several that recently qualified for multi-family tax exemptions. File photo

The MFTE, which has existed since 1997, is increasingly used as a tool to incentivize developers to include affordable housing in the city center or along part of the Mill Plain corridor.

However, last year it was scrutinized after several developers were granted the exemption, and councilors found that what is considered “affordable” was defined by the median household income in metropolitan Portland, which is roughly 30 percent Family income is above median in the Vancouver region alone.

In response, the council directed staff to look for ways to adjust the formula to focus on median income in Vancouver and then address concerns that the change could dampen downtown development.

Instead, the Council seems ready to make changes to the MFTE, starting with changing the terminology. Instead of “affordable housing”, developers could include “income-dependent housing” in return for property tax breaks of up to 12 years.

Vancouver City Council will be considering changes to its multi-family tax exemption program this coming Monday. This is the first step in a process to reform the affordable housing incentive. Image courtesy of Vancouver Community and Economic Development

Vancouver City Council will be considering changes to its multi-family tax exemption program this coming Monday. This is the first step in a process to reform the affordable housing incentive. Image courtesy of Vancouver Community and Economic Development

The council could continue to work to tie the tax exemptions to affordable housing based on Vancouver’s median income, but would likely address this in the second phase later this summer.

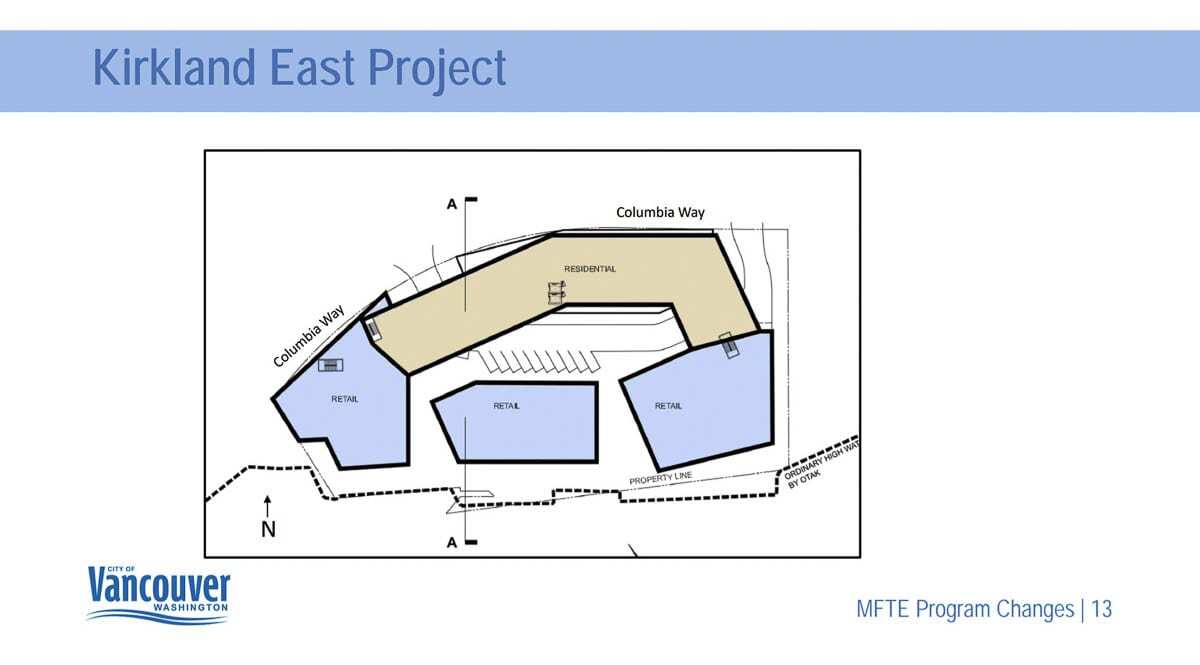

The plan, unveiled at an initial hearing on Monday evening, would also remove a number of public improvements that currently allow developers to qualify for property tax breaks and expand the MFTE boundary to a 2-acre property just east of the Interstate Bridge Currently the restaurants are Who Song and Larry’s and Joe’s Crab Shack.

The site’s owner, Kirkland Development, has proposed a multi-story building on the site with up to 220 marketable units and 140,000 square feet of office, retail and restaurant space.

Vancouver City Council could vote next week to include 2 acres east of the Interstate Bridge in its multi-family tax-exempt overlay. Image courtesy of Vancouver Community and Economic Development

Vancouver City Council could vote next week to include 2 acres east of the Interstate Bridge in its multi-family tax-exempt overlay. Image courtesy of Vancouver Community and Economic Development

Chad Eiken, the city’s community and economic development director, said Kirkland will demolish and rebuild the city-owned pier along the waterfront, which has been closed over concerns that it may collapse.

“We don’t have an estimate, but it would be a significant cost to the city to remove this structure,” Eiken told the city council. “And that’s exactly what the developers propose for the city. And then they would build the coastal path in the highlands of the site. “

Councilor Sarah Fox was the only one who did not vote on the proposal as it currently exists.

“I’ve been pretty consistent about my reluctance to push the boundaries of our MFTE area when we have a lot of work to do,” said Fox. “Push the line before we really agree on what this program should look like … It’s just not done yet.”

A planned development on the current Joe’s Crab Shack and Who Song and Larry’s property would include up to 220 residential units and 140,000 square feet of commercial space. Image courtesy of Vancouver Community and Economic Development

A planned development on the current Joe’s Crab Shack and Who Song and Larry’s property would include up to 220 residential units and 140,000 square feet of commercial space. Image courtesy of Vancouver Community and Economic Development

The current proposal would broaden the definition of what counts as a public benefit, but require it to cost the developer at least 25 percent of the total tax benefit.

Parking used to qualify as a public benefit as well, but would now only do so if it were included in a structure, not on the street, and only 10 percent or more above the current downtown parking minimums.

Some of this could be a dumb point after the Washington legislature finishes its work.

“At the state level, there is some movement to change the state’s requirements for tax exemptions for apartment buildings,” noted Eiken. “We are closely monitoring this and will know more once the legislature is over how this will affect the city’s local ordinance.”

Removed energy efficiency standards

Another change would eliminate energy efficiency as a potential nonprofit option, though Eiken said the developers could still propose it in exchange for tax incentives.

“The burden is on both the employees and you as the decision makers say, ‘Okay, how much benefit is that? And is it enough of an advantage? ‘”Said Eiken. “And it’s really hard to quantify things like improved landscaping and energy efficiency.”

Councilor Ty Stober said removing the non-profit contribution to energy efficiency “causes me a lot of heartburn,” but the city is also working to finalize its climate change plan and could revisit the issue as part of that process.

“The benefits of delivering renewable energy in an urban area are obvious,” agreed Councilor Bart Hansen, “and this could be one of the incentives we could offer to make this happen.”

The Council will hold a public hearing on the proposed changes at its March 15th meeting. A possible final vote will follow.